Metaversal Stew

Revenge of liberal arts. Media valuations. Everything's computer!

ON THE POD: Oral Exams, Episode 125

AI is giving rise to vibe coding while old conventions fall away. Thinking on your feet is now more important than rehearsed, polished presentation, which soon can be done with the push of a button. It’s time to find your inner Rick Rubin. Plus: How to build an Franchise brand. Listen on Apple | Spotify | other podcast platforms. Watch PvA on YouTube. Out every Friday AM.

Too long… Read this in the browser.

PVA CONVERSATION

Vibe talking

TROY: A couple of weeks ago, I speculated how services like ChatGPT were evolving into new creative workspaces, rivaling writing tools we use today (Word, Notion, Google Docs). Work would evolve closer to AI chat interfaces. Creating content inside of ChatGPT seemed liberating and expansive.

Seems something bigger is happening. It is not unique to writing — it is happening across disciplines. The lines between thought, research, creation and code are being erased. A new way of working is both supercharging human initiative, making the creative process more natural and interconnected: wonder - ask - think - research - write - code - design - ask - visualize - iterate - dispose - reimagine.

Tech people have their own version. They call it “Vibe Coding.” Andrej Karpathy, co-founder of OpenAI, coined the term in February in an X post that will go down in infamy:

There's a new kind of coding I call "vibe coding", where you fully give in to the vibes, embrace exponentials, and forget that the code even exists. It's possible because the LLMs (e.g. Cursor Composer w Sonnet) are getting too good. Also I just talk to Composer with SuperWhisper so I barely even touch the keyboard. I ask for the dumbest things like "decrease the padding on the sidebar by half" because I'm too lazy to find it. I "Accept All" always, I don't read the diffs anymore. When I get error messages I just copy paste them in with no comment, usually that fixes it. The code grows beyond my usual comprehension, I'd have to really read through it for a while. Sometimes the LLMs can't fix a bug so I just work around it or ask for random changes until it goes away. It's not too bad for throwaway weekend projects, but still quite amusing. I'm building a project or webapp, but it's not really coding - I just see stuff, say stuff, run stuff, and copy paste stuff, and it mostly works.

Perhaps it’s more simply understood by another Karpathy line, “The hottest new programming language is English.”

Vibe coding is an AI-assisted approach to software development where individuals describe their desired outcomes in natural language and AI tools make the code. Soon, normal people can create functional software by interacting with AI models through written prompts or voice commands.

People turned Rick Rubin into a vibe coding meme because he makes music but doesn’t play instruments. Rick likes vibes more than code.

Bilawal Sidhuwill will give you a sense of where things are going. Watch this video, it’s worth your time:

Or, have the Y Combinator people explain it.

Consequences:

Creative and coding collide. Technical literacy a requirement everywhere;

More software applications become fit for purpose. We make tools as we need them;

We reconsider ingrained ideas about packaged software and SaaS;

Coders don’t need to spend nearly as much time coding. They become product people and systems designers;

A new army of process and productivity gurus emerge;

Technical moats disappear. Taste, experience and attention grow in importance as differentiators;

Forces a massive rethink in education, disciplines, role definitions and career paths;

Ultimately, we see the world differently, an ever evolving virtual and physical reality stew that we collectively create.

Brian, are you feeling it?

BRIAN: I’m trying to figure out whether there is vibes writing. I use ChatGPT increasingly as a tool in my writing process. I have a project with all of my past writing. I tend to use it a few ways:

Round out work with examples and ideas I’ve already discussed. I can’t remember everything I’ve written.

Work through concepts. This is a work in progress. I find ChatGPT a complete suckup. It thinks all of my ideas are great and very astute. I have my suspicions.

Tell me what past newsletters to link to. One of the biggest quick wins for newsrooms and AI is related links. This should never be a (solely) human job.

Summarization. It’s very good at being able to summarize a podcast. I tend to use it to cut out half the time for these kinds of tasks.

Create new formats. The secret of media is wringing new value out of old content. I’m using it to develop new content packages like guides.

In all of these cases, I use it as assistive technology. I have no interest in replacing myself from this process, although there are lots of other areas of the business that I’m happy for the robot to take over.

My working hypothesis is that these tools will widen gaps. Like your philosophy professor said, the good students use it to be better. The lazy kids use it to skip work. I don’t know if it’s fair or unfair, but I’ve always found the most successful people have curiosity and drive. Those people will become superhumans. But it will put pressure on people who tend to coast or look for shortcuts. These tools are attractive shortcuts. The greatest skills to have will be curiosity, self-discipline, adaptability and resilience. I don’t see the world getting less complex and chaotic.

This is a side note, but I also used ChatGPT to better understand how people who have experienced being lost at sea used hope. It came from something I’d read about a guy who was adrift at sea with his wife for 117 days. The common thread of the experiences was that hope played a critical role and it was always an act rather than passive. It was very hard-headed and practical.

What is media worth?

TROY: Anonymous Banker kindly shared a media valuations spreadsheet this week, showing public media and digital marketing company EBITDA multiples.

As I was looking at it, Buffet’s notion of “Franchise Value” (see last week’s note) came to mind. I visualized these companies as sitting along a continuum. Something like this:

Everybody wants to be on the far left. Here some mix of brand, IP value, talent, network effect or rarefied operating complexity gives you enviable market power that should be reflected in high multiples. Mostly these companies enjoy stable, direct, paid connections to audiences.

Media used to be the Franchise currency. Now it is typically media plus something else (tech utility).

Arb sits at the opposite end of the line. Perhaps the “Arb” label is unkind (a badge of honor or affront depending on how you see the world). These are largely monetization companies, businesses that exploit the complexity of the digital ecosystem, as lead generators / performance marketers. They are ad companies or marketplaces first, media companies second, soundly profitable but with lots of risk. They lack meaningful, direct connections to audiences. Consequently, many have significant platform exposure to Google, Meta and next gen AI, etc.

In the middle you have the Survivors — they are in the game but not winning the game. In the magazine media’s halcyon days, Vogue had Franchise value. Marie Claire was a Survivor. Survivors are nice people to hang with after work.

Per Warren Buffett's Franchise comment, local newspapers always had Franchise value thanks to their local monopoly position. All have shifted to the right over the past 20 years.

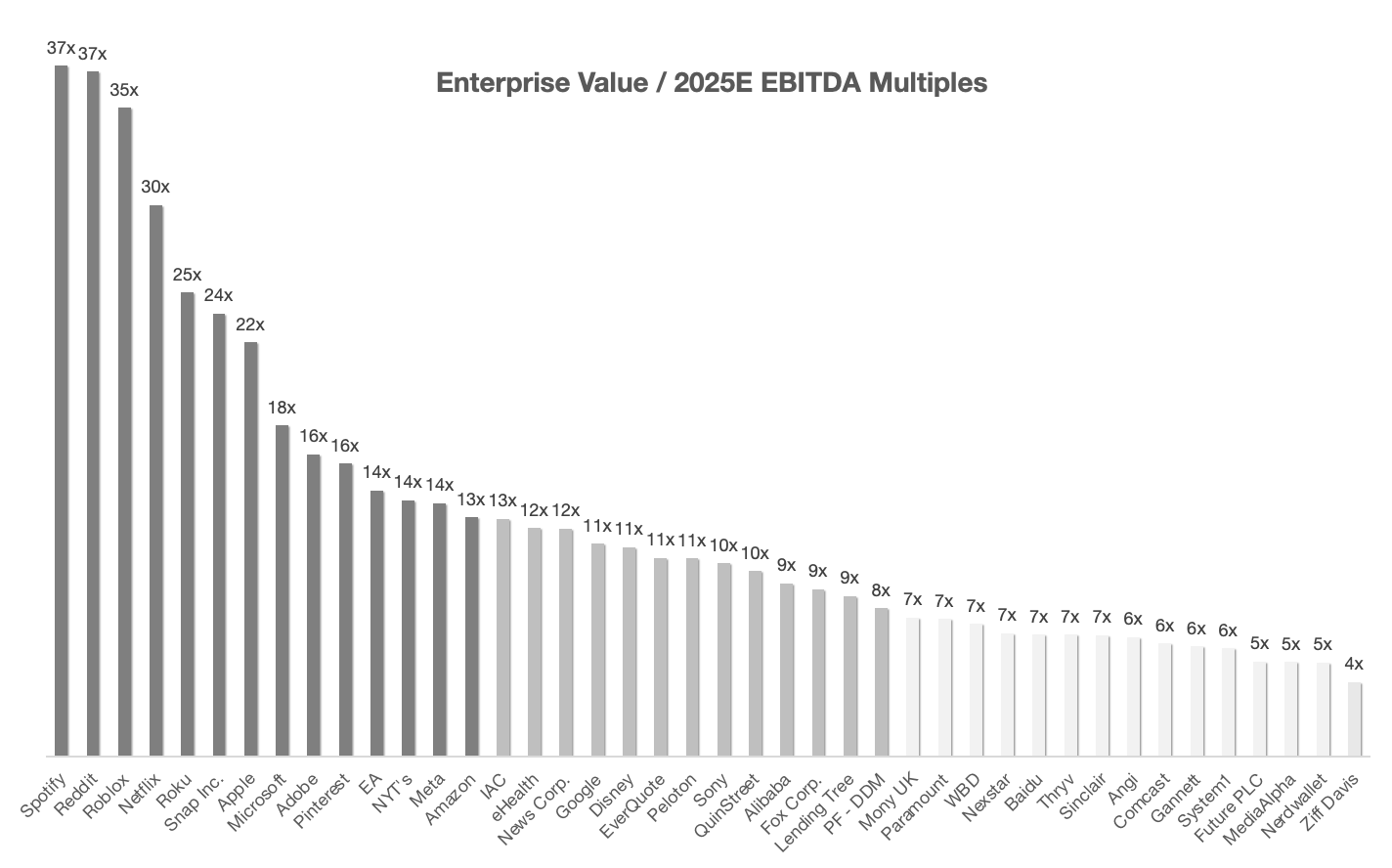

Indeed, most media has steadily shifted to the right, replaced by platforms and tech / media hybrids. See examples in the bar chart below (using EV/2025E EBITDA multiples). Franchise players should see at ~13x or more, rare in media (NYT 13.8x) but commonplace in tech / media hybrids (Apple, Spotify, Netflix, Meta, Amazon, Roku). Note: multiples are a snapshot, based on enterprise values and earnings estimates at a given point in time and are obviously an incomplete measure.

Is Reddit a media company? Why not? It’s content you read, made by humans (presumably). The community mechanic (free content from you and me) is good for margins. Being the place where actual humans gather and talk about stuff is a good place to be right now. In the old days of Franchise media, this was not seen as media. It was seen as garbage. Times change.

Who else has Franchise value now? Obviously good sports assets. Mr Beast is raising money at a $5B valuation with little to no profit. A24 seems to have Franchise value. The New Yorker still does. The Atlantic? Maybe Forbes?

On the Arb end, think of ad networks of old, now companies like NerdWallet (5.1x), System1 (5.8x), MediaAlpha (5.1x), Angi (6.4x). EBITDA multiples sit between 5-8x. Companies with brands or complex service categories like LendingTree (8.6x) carry a premium. This is simplified of course. Lots of short-term valuation changes can contort multiples, but you get the gist.

I would expect to see multiples in the 8-12x for Survivors. The trouble is, what we may have once seen as having Survivor (or even Franchise) value and moving right to approach Arb valuations, in many cases less. Gannett (5.9x), Ziff Davis (4.0x), Future (5.1x), Sinclair (6.5x). Ziff is a poster child for the market fallout of media. Despite healthy margins (35.6%, 2025E) the market hates the stock and seemingly doesn’t believe in its revenue sustainability given Google risk. Note: DotDash Meredith is tucked inside of IAC. Other assets in the IAC holdco obscure its multiple. Analysts peg it around 8x.

Maybe this reveals what we all intuitively understand. Media without Franchise value is trading ever lower. Few have it. Arbitrageurs are not envious anymore. Small, nimble, private players are eating the middle of media. Very few pure media companies outside of Netflix and the New York Times have created moats through a combination of content and technology.

Anonymous banker, what am I missing here? Any thoughts Brian?

AB: The continuum for media and tech companies—ranging from Franchise players to Arbs—offers a valuable lens for understanding M&A strategy. Franchise businesses have the flexibility to invest heavily in capex while paying premiums in M&A processes. Survivors, stuck in the middle, struggle to maintain investor confidence and are much more selective in processes, sometimes deconstructing their businesses rather than pursuing growth to unlock value. Arbitrage players are the least acquisitive of the bunch, often focused on preserving and returning capital to investors in an effort to maintain multiples.

When bankers pitch deals, they typically focus on one of two financial rationales. First, acquisitions can be accretive, meaning they enhance financial metrics by purchasing businesses at lower multiples than the buyer’s current valuation. A company trading at 12x EBITDA acquiring one at 6x benefits from multiple arbitrage, meaning the acquired company’s earnings immediately contribute more value to the parent company's financials because the market values the buyer’s earnings at a higher multiple. Second, M&A can be transformational, with the potential to reposition the acquirer and trigger a “rerating” by shifting market perception. This strategy is riskier but can be a lifeline for companies facing multiple compression.

The shifting landscape (Franchises moving to Survivors) is particularly evident in media, where legacy franchises like Disney and Comcast, once dominant, are now grappling with declining distribution power and changing consumer behavior. The rise of free, ad-supported streaming, the dominance of digital aggregators like YouTube and TikTok, and the devaluation of traditional cable bundles have fundamentally altered the industry’s economics. Investors are increasingly skeptical of media companies without proprietary distribution, leading to compressed multiples and reduced M&A flexibility.

This has had a knock-on effect: sell-side processes that would typically attract a significant number of bids are now more focused, relying on a smaller pool of buyers to find homes for assets. As a result, M&A processes are becoming increasingly tailored, with dealmakers crafting more precise narratives around growth potential and synergy opportunities to secure interest in a more challenging market. The days of broad, competitive auctions are giving way to more strategic, one-on-one negotiations.

BRIAN: I’m very surprised we have an investment banker extolling the benefits of M&A! I’m reminded how comedian/banker Terry Kawaja is regularly saying consolidation is desperately needed in ad tech. I know a guy who can help with that.

I’m interested in the new landscape of buyers for media companies. Tastemade just sold to Wonder, the food delivery company. It was a $90 million deal for a company that raised $131 million. Ouch. But the reality for many media companies is that they will be a front end to a different business. Think of The Infatuation. It’s still a good media property, only its economic purpose is to market Chase credit cards and provide perks to Sapphire members. They got out at the right time.

The reality is very few media companies have franchise value, and even fewer will in the creator era where so much value is wrapped up in individuals. And more of the survivors are getting shoved down the line to arb. (It’s an honorable role.) The most sensible way to get to franchise value is to build an ancillary business that isn’t media. Mr. Beast is a chocolatier with a breakeven media operation. The continuum is missing the far larger set of media companies that are small and scrappy.

Sausage links from the group chat

1: Come on down to the White House Tesla Auto Mall! (Reddit)

2: Not everybody is happy when Dems engage the right. I thought it was a good idea. Steve Bannon is tough to spar with. Gavin Newsom makes him more likable and distinguishes himself in the process. (This is Gavin Newsom podcast)

Related: Long form podcasting is “too masculine” for limp-wristed liberals.

3: Gen Z listen to podcasts on Spotify. (Transistor)

While YouTube dominates podcast listening overall, our latest survey reveals that Gen Z strongly prefers Spotify (56%) and overwhelmingly chooses audio-only formats (76%) over video. These findings challenge common assumptions about young listeners' podcast consumption habits.

4: Mixed feelings on whether corporate outings at bathhouses are a good idea. (Feed Me)

5: Google teases full AI mode. (Google)

I have a new theory called The Guy theory of politics. No democrat is The Guy right now. They have no The Guy. You need a The Guy to even possibly confront Trump who has insane levels of The Guy-ness not seen since 2008 Obama.

Grace Freud (X)

6: Adam Neuman builds media startup on back of residential real estate concept Flow. (Axios)

7: Thousands of Cat-Eared Robots Are Waiting Tables in Japan’s Restaurants.(Bloomberg)

Faced with a severe labor shortage and one of the world’s most rapidly aging populations, service-sector businesses in Japan are increasingly investing in robots that don’t need expert supervision and can work alongside people instead of replacing them. So-called service robots are also making it easier for firms to employ older or foreign workers — crucial to plugging the shortfall — by helping them cope with language barriers or the physical demands of a role.

8: Are major AI driven scientific breakthroughs on horizon? (NYT)

The big, inspiring A.I. opportunity on the horizon, experts agree, lies in accelerating and transforming scientific discovery and development. Fed by vast troves of scientific data, A.I. promises to generate new drugs to combat disease, new agriculture to feed the world’s population and new materials to unlock green energy — all in a tiny fraction of the time of traditional research.

9: The next Cheddar? TBPN (Technology Brothers Programming Network) is interesting new live tech / finance daily show. Hosted by @johncoogan and @jordihays. Three hours live, Monday - Friday on X and YouTube.

10: American affluenza. (X)

Airports these days are a perfect picture of American affluenza. The US upper-ish class has too much money, but never enough.

Lots of suspicious “pre-boarders,” teens in designer clothes, $500 headphones muttering ‘what?’ to flight staff. There are like 50 people in “boarding group 1” now, as well. You can see the confusion on people’s faces who’ve clearly been boarding first for a while, who now wait 20 minutes standing just to have their spot in line!

11: Nicholas Carlson found the intersection between entertainment and business at Business Insider. Now he’s building Dynamo, “cinematic journalism for people who believe business explains the world.

12: The return of “I am Canadian.” (X)

13: Everybody is drooling over general AI agent, Manus. When do we get to play it? MIT Tech Review did.

Since the general AI agent Manus was launched last week, it has spread online like wildfire. And not just in China, where it was developed by the Wuhan-based startup Butterfly Effect. It’s made its way into the global conversation, with influential voices in tech, including Twitter cofounder Jack Dorsey and Hugging Face product lead Victor Mustar, praising its performance. Some have even dubbed it “the second DeepSeek,” comparing it to the earlier AI model that took the industry by surprise for its unexpected capabilities as well as its origin.

Manus claims to be the world's first general AI agent, using multiple AI models (such as Anthropic's Claude 3.5 Sonnet and fine-tuned versions of Alibaba's open-source Qwen) and various independently operating agents to act autonomously on a wide range of tasks. (This makes it different from AI chatbots, including DeepSeek, which are based on a single large language model family and are primarily designed for conversational interactions.)

14: Annie Saunders is writing a weekly newsletter called Trumplessness, where the only place Trump appears is in the title. (Today In Tabs)

Bonus: How long would it take to fill the grand canyon with piss. Glad you asked. (X)

GOOD PRODUCT

A love letter to LA

Singer, songwriter Cuco’s ICNBYH is ice-cold joy. More important to media makers, how the team leveraged AI to make the accompanying Love Letter to LA video . Also… his Tiny Desk.

PvA remains on point in being the only pod taking a genuine full 360 Sauron-esque sweep of the media landscape rather than getting befouled in the weeds of sector minutiae.

This is vital because if we view media through the lens of AI being one of only 23 General Purposes Technologies in history (electricity, steam engine etc.) with each having a civilisational and unpredictable impact - but belonging to an even rarer subset in being one of only four so called 'Hyperludic Accelerant' (the others being Language, Writing & the Printing Press) which are technologies that change the very nature of our relation to Information itself and which act as both mirror and extension of the mind itself then the true extent of AI's impact becomes very apparent.

History shows that those institutions and industries that hold the previous Hyperludic Accelerant in their DNA are ones that become most exposed to the disruptive effect of the new Hyperludic Accelerant.

For example those who had previously cornered the writing market; scribes, illuminators, church officials & scriveners were the first to get entirely upended by the introduction of the Printing Press- just as those who had cornered the Language Trade: preachers, oracles, heralds and story tellers were themselves wholly disrupted when Writing came along.

So now too the media in all its guises as ultimately a child of the Printing Press is now facing the same level of impact and disruption down to its very bones.

Luckily it's probably the PvA hosts combined media depth and savvy that's made them intuitively grasp that there's very definitely an East wind blowing, and of course being seasoned media types they are greeting it with the industry's traditional reaction of laconic panic.

Which is a a good thing because right now neither running around like a gibbon having discovered a bush fire or ignoring it like a monk studiously illuminating a manuscript to the rhythmic 'whump' 'whump' of the new printing press next door are desirable ways forward.

I'm really hoping there's a quiet cadre of influential media minds listening, absorbing and reflecting on PvA's output because if not there's soon going to be an enormous glut of the modern equivalent of vellum and quills hitting the market.