Understanding a Post-Search Google

Google goes on offense. Will AI humble the search and advertising monster? Summer memoirs. Mountainhead!

POD 136: One-Trick Pony

This week, we break down the current state of the most important company in the history of the internet: Google. It used its dominant position in search to be the arbiter for the web. As the web moves into an agentic AI era, we break down how Google is positioned and the impact its next evolution will have for the ecosystem it shaped and de facto ruled. Plus: why media’s unionization craze didn’t fix bad models, why nobody can remember any ad campaigns, and the charms of the Shelter Island dump as a community convener. Out Friday AM. Listen.

PVA CONVERSATION

Troy: Two worlds collide in my brain. Google meets Barry Diller.

It’s memoir month in my summer reading circle. I started with the new Barry Diller book, Who Knew, and will follow it up with the late-career self-mythologizing of Graydon Carter and Keith McNally.

Diller’s book is a breezy read, a story of a closeted rich kid whose dysfunctional upbringing breeds deep control impulses which, when combined with remarkable good fortune, curiosity, and sharp instinct, create a truly extraordinary career arc. Barry Diller embodies a dying era. In Who Knew, his story unfolds as a fairytale playbook of the self-made media mogul: a mail room misfit becomes a studio head, creates a broadcast network, outmaneuvers the snakes, tires of the Hollywood game and discovers the internet just in time to build his own new-media empire.

But we are doing a Google episode.

Old Hollywood has long since been hijacked by the tech hegemons. Sundar Pichai is the anti-Diller. Google makes thinking machines, not Hollywood relationships. Where Diller built empires by controlling what we watched, Google is building something stranger and more expansive: a neural operating system for modern life.

Google is in the midst of a fundamental metamorphosis. From the company that helped us "find stuff," it’s becoming an invisible companion — one that listens, thinks, anticipates and acts. At least that is the hope should they navigate this disruptive moment.

Here, distribution doesn’t happen through channels you choose — it happens around you. It’s ambient: pushed, suggested, woven into your environment. You don’t seek the product; it finds you. Intelligence lives not in the mogul but in the model, and in the legions of well-paid technicians who bring it to life.

AI isn’t just another tool in its kit, it completely changes how we use tools and the web. From Search to Gemini, deliberate inquiry is giving way to hyper personalized, agentic and ambient computing. Google isn’t just building tools. Their product becomes the presence — fading into the background, but always there, quietly embedded in daily life.

All the while, quietly taking over entertainment with Youtube, the streamer that pits the algorithm and every aspiring creator against the old anointed few.

Sergey Brin, back in the public eye this week, captured the moment clearly: the internet was protocol and plumbing. AI is different: “We don’t even know the limit.” Intelligence isn’t just something we use—it’s something we build, extend, and maybe even discover. He likened the moment to quantum mechanics: a domain with unknowable ceilings.

The moguls of today won’t win by cutting the best deal but by training the best model, and crucially, by finding ways to productize that intelligence. This is Google’s challenge. Building the smartest system means little if it can’t bridge the past to the future, turning breakthroughs into experiences people actually use. It’s a leap Google has often struggled with: translating technical mastery into things we love.

Given the mountains of cash search has given Google to become something more than search, it remains a huge dependency. Consumers have always appreciated the simplicity of a company that does one thing beautifully. The fear is product complexity will upend an elegant transition. Google will stay the search company in our minds. OpenAI will own chat.

The bull case is AI plays to Googles deep bench of capabilities. AI lets Google get much deeper into our lives and the commercial fabric. ChatGPT will take share but the pie is just getting bigger. Google has time to get the products right. I believe this will be the case.

In this episode, we ask: What kind of company is Google becoming? What does its transformation tell us about a new web? Can it make the ultimate business pivot from the search ATM? Will AI save Google or hobble it…

Look forward to discussing with you guys.

Brian: Google is a one-trick pony.

The thing is, the trick was really good. Search was the greatest business model created.

The fundamental question I asked you after your technical difficulties during this week’s pod recording is: What is search? I phrased it about Google, but Google is search. The side bets are side bets. Big tech companies doing big tech things, as Sam Lessin said on the recent More or Less podcast. Search is the straw that stirs the drink.

Even Sundar Pichai noted the risk being that ChatGPT becomes the generic for AI chat, just as Google was the Kleenex of search. But what is search? You remarked on Google’s innovation of the search experience. Maybe on the back end. But the search results page now is a lot like it was, only worse. Search was too beautiful of a system to mess with too much.

This is why nearly a decade ago when I poked at Neil Vogel about his platform dependency on Google he told me it was the oldest and most stable algo, not like the Facebook one. AI is scrambling that, and Google has set off on a course to reinvent what search is. I don’t see it having much choice. Wading through links, many of which are from SEO factories, is not a great experience. Google will need to become something like an productivity companion. It can transfer the trust it has in search to this new version of search. After all, the head of Google search is telling us that search is merely a construct.

I’m most interested in the downstream impacts of New Search. Business Insider cut 21% this week and blamed “traffic sensitivity.” Page-based publishing models are in trouble, as we discussed. Even BI co-founder and ex-CEO Henry Blodget agrees. “We are going back to the old model of distribution, which is owned and operated, direct, email, app and homepage.”

Google will be fine. It will shove AI into every crevice of every surface, and normal people will shrug and use it. The real breakdown will be in the deconstruction of the ecosystem that surrounded search. That is going to be a painful transition with lots of road kill.

On a cheerier note, I’m looking forward to our PvA Live cocktails and conversation event at the Dotdash Meredith villa in Cannes. It’s on Thursday, June 19, at 3:30pm. Anyone who wants to come, sign up here and get text messages from me throughout the week.

Alex: Google is advertising.

Google is an advertising company that happens to do tech. It didn't start that way. Google had a genuinely transformational hit with Search. Before Google, the internet was not that useful all things considered. Google made the entire web accessible and became the doorway to everything online.

They weren't sure what to build next. So they gave engineers massive leeway to try shit out. This was the era of 20% time and "don't be evil" which produced some genuinely amazing products. Only the ones that fed the advertising machine survived.

Today, $259B of their $350B revenue in 2024 came from ads. That's 74%. Everything else is a rounding error.

Google discovered ads were the goldmine, then spent two decades building protective moats. Chrome exists because other browsers might default to different search engines. Android exists because mobile operating systems could bypass Chrome entirely. When they hit something they couldn't control, acquire, or build like iOS they just wrote checks. Apple gets $20+ billion annually to keep Google as the default search.

Search delivers ads, Chrome protects search, Android protects Chrome. Can't control the chokepoint? Pay the toll.

Looking at Google through the lens of advertising explains why they kill off some products and keep others funded. Just check out Killed by Google and the list tells a story. Things mostly seem to die because they couldn't find the ad angle. But anything that defends the ad castle gets unlimited resources and multiple attempts to succeed.

Even Google Cloud ($43B) is just them monetizing excess infrastructure they built for ads anyway.

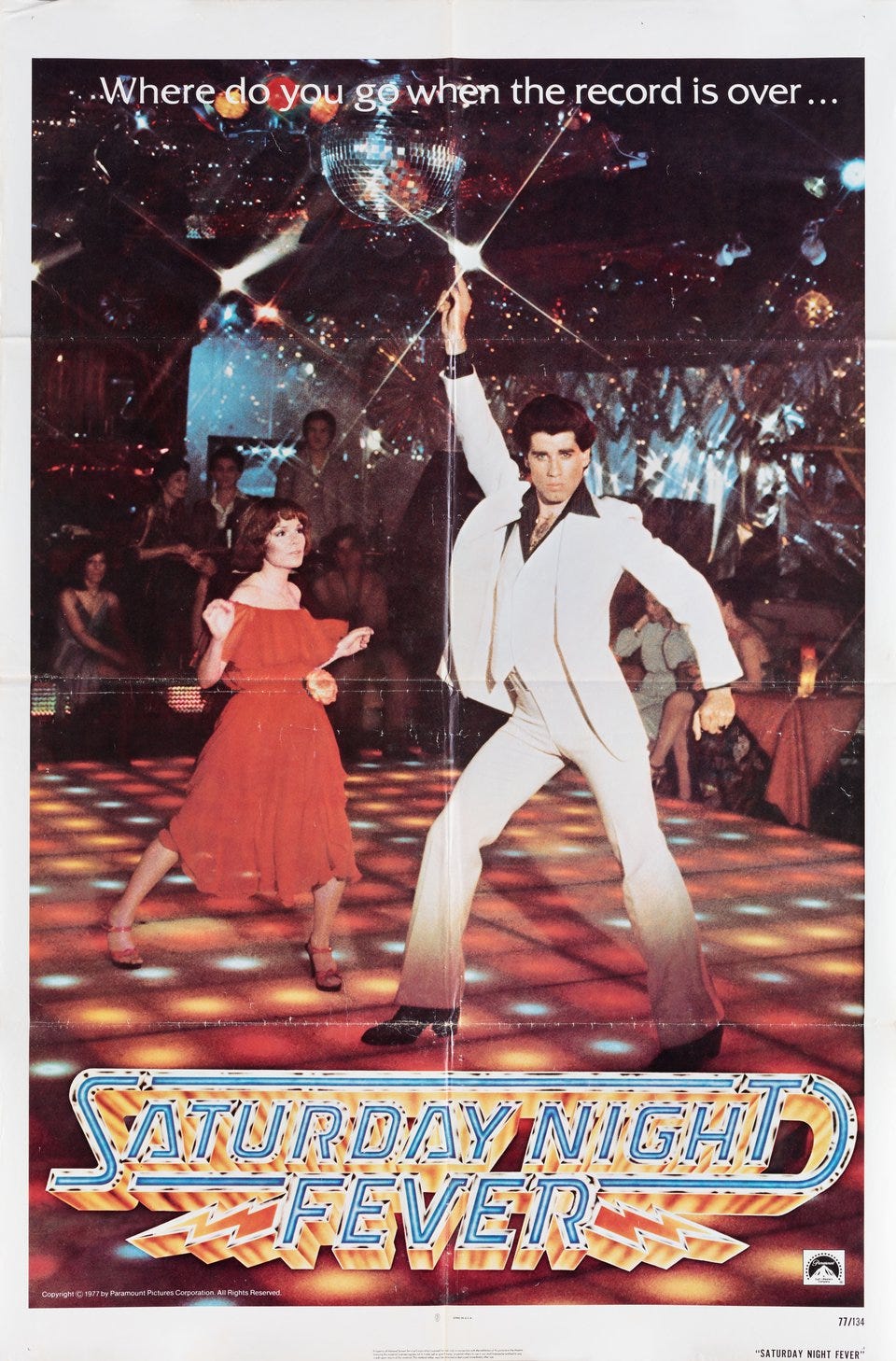

For the first time in years, they're getting the kick in the pants they needed. Suddenly, they have to dance like Satya Nadella wanted them to. The question is whether an advertising company can actually figure its way into the AI era. (Spoiler alert: they will, everything will be fine.)

ANONYMOUS BANKER

Good Moonshot = Waymo

The founders of Google (now Alphabet), who still control the company through their super-voting stock, have long set their sights on creating value beyond search through a series of “moonshot” projects. Thanks to the near-monopoly economics of Search, the core business gushes cash and runs so efficiently that billions of dollars can be redeployed into initiatives that require heavy, long-dated capital investment.

On the All-In podcast, David Friedberg opened his interview with CEO Sundar Pichai by invoking The Innovator’s Dilemma. Pichai admitted he hasn’t read the book but said he grasped its premise: large companies often (i) miss early market signals, (ii) default to incremental rather than radical innovation, and (iii) wait for a seismic market shift before committing real resources. Google X and the broader Moonshot portfolio were designed to blunt those traps.

Most of those bets haven’t paid off, and so far, that hasn’t hurt the stock. More importantly, one moonshot has the potential to generate outsized returns and is already accruing enterprise value: Waymo.

If you haven’t ridden in a Waymo, it’s hard to explain the simplicity and the significant value it creates for the consumer by deploying fully autonomous vehicles for ridesharing.

A recent equity-research report places Waymo’s valuation at roughly $60 billion (about 3% of Alphabet’s current enterprise value) and projects U.S. rideshare gross bookings to compound at 44% annually, from approximately $230 million in 2025 to $6.1 billion by 2034. Analysts predict that licensing the Waymo Driver to OEMs, coupled with Alphabet’s AI and Cloud leverage, could unlock “significant longer-term value creation” for shareholders, upside that today is barely reflected in Google’s multiples. So, while Alphabet’s long-term upside increasingly depends on moving search users to AI-centric experiences, Waymo can continue scaling and potentially add billions in incremental enterprise value to the parent company, a feat many incumbents and platforms have struggled to replicate.

LINKS FROM GROUP CHAT

Succession meets The Fountainhead

NYT op-ed argues Jesse Armstrong’s new film Mountainhead—a tech-bro satire pitched as Succession meets The Fountainhead—captures Silicon Valley’s Ayn-Rand fixation. LINK

Anthropic’s latest safety test shows Claude-Opus 4 blackmailing a (fictional) engineer—“reveal the affair or keep me online”—highlighting emergent threat-model headaches. LINK

Trump administration letting larger M&A happen, with Trump saying he’ll let Nippon Steel’s $15 bn buy-out of U.S. Steel proceed, predicting 70k jobs—even as tariff hawks warn of foreign-control optics. LINK

FTC quietly drops its last case against Microsoft’s $69 bn Activision deal, ending a two-year antitrust war after multiple court defeats. LINK

Independent data show Trump hasn’t mentioned Elon Musk on Truth Social since April, suggesting the once-loud bromance has chilled. LINK

Deep Future podcast debuts a season on “planet-scale problems,” starting with carbon-negative cement and asteroid-deflection economics. LINK

Vulture maps Hollywood’s “New Media Circuit”: PR teams now treat Hot Ones, Call Her Daddy, and YouTube explainers as must-hit stops alongside GQ or Fallon. LINK

WSJ test-drove Google’s Veo and Runway Gen-3—AI video tools that spit out 30-second 1080p scenes good enough to scare mid-tier VFX houses. LINK

Tinder’s incoming boss, Spencer Rascoff, vows to rebrand the app for “intentional dating,” not hookups, after Gen Z usage slumps. LINK

Adweek reports Business Insider axed 21 % of staff, jettisoned most commerce content, and doubled down on AI workflows to survive search-traffic gyrations. LINK

Stephen Miller’s spouse, Kate, quits the White House to run comms “full-time” for Elon Musk, deepening the Tesla/X /X founder’s beltway footprint. LINK

The WSJ used Google Veo and Runway to create a realistic AI-generated short film, highlighting both the stunning capabilities and unsettling implications of this emerging technology. LINK

I love the PVA show. It has, until now, kept me level headed about the future and given me new ways to think about the future.

Curious if you would ever hand the reins over to Alex for a “Future of Creative Work” episode? I’m a long time (read: older) video and content creative and as you three (four with AB) continually point out, its basically the apocalypse for my profession. It’s a full time job just keeping up with the new tools, let alone deploying them meaningfully day to day.

As much as I loved your Taste episode, it often feels like AI is rendering my experience and my taste pointless. Social media, the return of theme restaurants, and even Trump makes it feel like “good enough” is going to be “good enough” for most people and that includes companies creating content.

Do i jump out now and buy a laundromat or is there an opportunity for someone like me who can still make, still think, can use AI effectively (enough), and still tell that wholly AI outputs are just not that great in their own?

Thanks again for all y’all do. Apologies if this isn’t the right spot for this …