Reconsidering Retail

In trying to understand what's next, look at the system under the sale, not where the customer gets the goods.

Welcome to People vs Algorithms #42.

I look for patterns in media, business and culture. My POV is informed by 30 years of leadership in media and advertising businesses, most recently as global President of Hearst Magazines, one of the largest publishers in the world.

If an indoor ski hill can’t save the mall, maybe MrBeast can.

This week, the YouTube sensation debuted Beast Burger at New Jersey's American Dream mall, drawing over 10,000 hungry fans who purportedly bought 5500 burgers, breaking a single restaurant record for the most sold in a single day. The struggling mega mall — really not a mall at all, more of a recreation center where you can buy stuff — welcomed the surge of youthful energy.

Scaling a Beast

Remarkably, the “virtual chain” has scaled to some 1700 locations across the US and UK leveraging the local spare restaurant capacity and the recent innovation in “ghost kitchens.” The two year old effort will reportedly do over $100 million in revenue this year. Is Beast Burger a stunt or an enduring business? Hard to say. Can you maintain a quality product through a chain of virtual restaurants? I am skeptical.

Jimmy Donaldson, AKA MrBeast, is certainly an uncanny marketer. Few celebrities would have the promotional energy to make something like this possible. The secret to his fast food success is not the burger, of course. It’s a YouTube-powered fan machine with 100 million subscribers, a content formula that combines outrageous stunts, game show drama, philanthropy and lots of cash giveaways. MrBeast and crew are extraordinary purveyors of digital attention gimmickry.

This is not the first time that MrBeast has monetized his fame via playful product extension. The clever MSCHF / Beast collab "Everyone Gets a Car" is a good example of his unique blend of lottery dynamics and playful media. Everyone who bought in to the drop got a yellow Lamborghini, you just didn't know if you would get a the toy or the real thing. More recently he's brought a Willie Wonka twist to chocolate with Feastables, his organic snack brand that sold over a million bars the first few days out of the gate.

But, MrBeast has broken new ground with the virtual restaurant concept, a phenomenon that would not have been possible prior to the emergence of on-demand infrastructure and the popularization of app-based food delivery. It is the connection between attention and the ability to rapidly scale delivery capability behind it that interests me.

Perhaps the phenomenon says something bigger about the reshaping of our economy. MrBeast reflects a world where products and physical distribution are fungible and mental distribution is the scarce resource you scale a business around.

Marketing and product are one

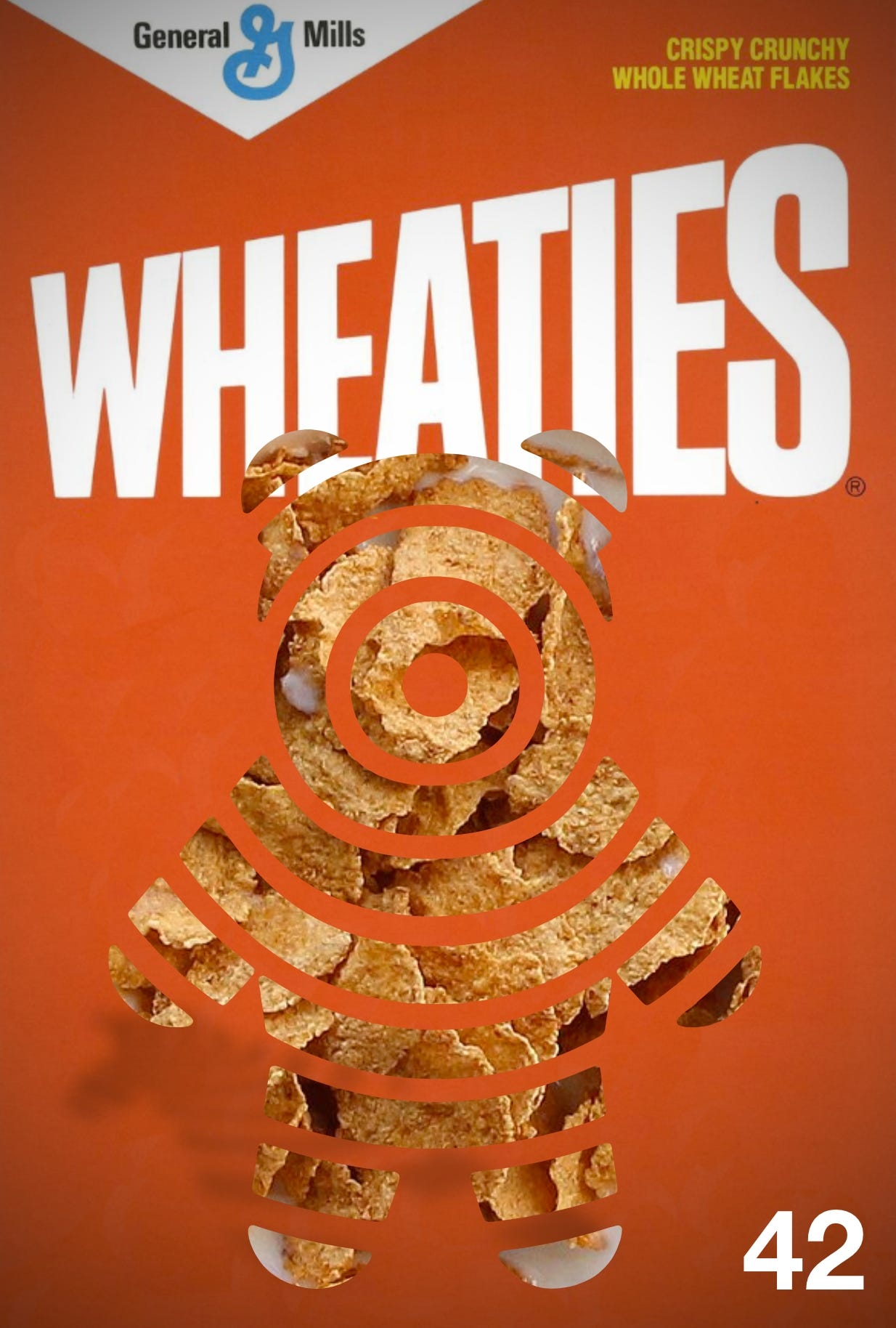

Celebrities selling things is not new. Endorsement is as old as marketing, but historically functioned as a rental model — lend your face on the Wheaties box, get paid and walk away. The modern twist assembles businesses in a lego-like way behind the celebrity-driven attention machine driving a deeper share of the economics.

Spirits have been a particularly fertile market, owing to ability to scale quickly, marginal differentiation and high margin potential. The prevalence of celebrity fronted brands has become comical. Your favourite criminal duo from Breaking Bad, Aron Paul and Bryan Cranston, find perfect alignment in tequila. The Rock has his own muscular take. Kate Hudson crafts the perfect vodka. Ryan Reynolds chooses gin. There are countless other examples in packaged goods, fashion and beauty. Emma Chamberlain brews coffee. Prime is Logan Paul's wildly popular energy drink. TikTok influencers Josh Richards and Bryce Hall flog Ani Energy. All pay respects to pioneers of the influencer / product movement Kim K. and Rihanna.

All demonstrate a trend where brands emerge quickly from personalities and the media weight they carry and, perhaps, are just as transitory. Few will persist. Some will function as short term water carriers for more permanent purveyors rooted in the craft and the making. Money will be made.

On demand retail

But a bigger point struck me reading this week’s NYT profile on Chinese fast-fashion brand Shein. Shein represents a disruptive new force challenging retailers Zara and H&M — a supercharged version of the offering that these innovators once pointed at more traditional rivals — dirt cheap prices, huge selection and fast turns. But Shein has pioneered a system that is even more nimble. It differs in how it optimizes a lightning fast, interconnected manufacturing marketplace to a social end point, supported by a micro-influencer reward mechanisms and an app-based sales/service model and, of course, a relentless focus on data. Here too, it’s the front end connection that really matters. Retail may follow, but it’s role is perfunctory in relation to the real value driver.

The piece noted how a recent pop up in a Plano, Texas mall was met with mobs of shoppers looking to experience the mysterious online brand first hand, and how the chaos stood in sharp contrast to lonely retailers flanking its temporary location.

Could they or should Shein open a national network of physical locations? Their customers would seemingly appreciate the opportunity to experience the brand and the math may pencil out in incremental sales. But it's just another marketing strategy, not a core distribution decision. It's made on the margin. What matters is optimized digital relationship powering a responsive supply chain. Value has shifted from the maker and real estate owner to the a merchandising and marketing system.

Old retail models scaled businesses around distinguished retail concepts via steady step-by-step geographic expansion. Take a novel concept like, say Williams Sonoma, a unique kitchen store founded in Sonoma California. Grow the retail footprint to similar upscale retail neighborhoods across the state and then methodically to suitable zip codes across the country. The physical network was the moat. I am not suggesting that physical distribution cannot provide advantage. But new models will blend the speed and agility of DTC thinking and internet media at the core with opportunistic retail investments that provide fast experiential opportunities. Real estate evolves to become an on-demand asset, like a WeWork or cloud computing.

Reconsidering the e-commerce metric

Covid drove new levels of adoption of online commerce. The long term economic and social implications are far reaching, business is highly investing in understanding how behaviors will correct as things get back to normal. But it strikes me that looking at e-commerce penetration is the wrong way to understand what's next. I don't think it matters if a transaction is consummated in a physical space or via delivery though an online interface. What really matters now is how a brand creates an efficient and persistent connection to the consumer that supports long term value extraction. These connections are largely digital. A new value chain entirely centered around a content-driven digital relationship reframes the modern economic equation. Physical versus digital sales is the wrong measure.

It seems to me retail is being reshaped as a dumb end point to smart digital value chains. Big box retailers like Home Depot become physical support environments for an app. Amazon fashion outlets provide places to merchandise influencer ensembles that can be scanned with a phone and delivered to fitting rooms with robotic efficiency. Malls become places for experience, food and community connection, with shopping and a stream of pop-ups as supporting attractions.

On the other end of the spectrum one hopes the highly curated, personal shopping experiences, the kind that make cities and neighborhoods fun to visit, persist.

The point being, the things that we once saw as fixed and permanent — retail and office locations, owned manufacturing — are increasingly fungible while the things we used to think of as easy to buy, attention in particular, are the deterministic drivers of a new model. This is a big shift in thinking as far as I can tell.

Brian Morrissey and I discuss these things and more in our latest People vs Algorithms podcast, out tomorrow. Find it wherever you get your podcasts.

Have a great weekend…/ Troy

The Most Popular Fast Food Brands in America

Faces: Glad and sorry

Very fond of this track. Happy and sad together. My pal Gary Louris covered it with his supergroup Golden Smog. Both versions hit the spot.