Deconstructing content to commerce

Why we talk about it so much, how it's changing merchants and media, what comes next.

Welcome to People vs Algorithms #3.

I look for patterns in media, business and culture. My POV is informed by 30 years of leadership in media and advertising businesses, most recently as global President of Hearst Magazines, one of the largest publishers in the world.

First Glance

Pictured above: Tyler Hobb’s Fidenza 313 sold in late August for 1000ETH or $3.13M at time of transaction. Tyler makes stunning “generative” art — NFTs created with algorithms. It’s the algorithm, not the art that lives on the digital gallery ArtBlocks. Pick a style you like, pay and a randomly generated version of the work is created by the artist’s algorithm and sent to your Ethereum account. Confused? That’s understandable.

Generative art has dominated the NFT world with wildly popular projects like Bored Ape Yacht Club and breakout successes, CryptoPunks and Cryptokitties.

Despite its economic success, not everybody loves the idea. From Art News:

“The most popular series of NFT collectibles are algorithmically generated,” Dean Kissick, the New York editor of Spike Art Magazine, wrote in a column back in March, when the NFT craze was just exploding. He was describing the algorithm’s claustrophobic effect on culture, and he isn’t alone in his prognostic. There are many critics who claim that algorithms do two things: produce bad art and cheapen culture as a whole…

Generative artists, for their part, believe that their medium is here to stay. Artist Tyler Hobbs, who has produced work using Art Blocks, said in an email, “The bulk of our lives [is] moving into digital environments, which are of course constructed with algorithms. Should artists strain to avoid these algorithms? No, we’re better off claiming them for ourselves.” In response to Kissick’s critique, Hobbs added, “I won’t claim that most algorithmic artwork is good, or that there aren’t a large number of people in it for the money, as always. But, if you actually understand the art form I think you’ll see that at the core there’s something special taking place.”

Content to commerce: why so important now?

Well, in the the most basic sense, the internet made it so — or more specifically, the hyperlink. It made media interactive, enabling the connection between the stimulus of media and the response of a transaction. Media has always influenced people to consume stuff — that’s why companies advertise. Over the past 20 years the world loaded a gigantic product catalog onto the internet, ironed out the process of payments, fulfillment and service. Now we move from media to checkout with a click. The two businesses, always close neighbors, are now existentially connected — like you and your in-laws. It changes everything.

Commerce needs the merchandising power of content to contextualize products. Products need to be found online and content gives Google something to look for. It’s modern distribution.

Media needs advertising revenue. Banners never quite solved the problem. Contextual links to products, paid for with a cut of sales, adds important marginal revenue.

Platforms (from iOS to Instagram), the substrate of online communication and content discovery, add commerce and fortify their dominant ad businesses. Now everybody can create and sell. And our credit cards rest securely inside of our phones and laptops, removing all friction from the process.

The pandemic made everything more pervasive. In 2021, US consumers will spend $930B on e-commerce, up 18% year over year (eMarketer). Online retail rose to 25% of total commerce during the pandemic (Forbes). 70% of publishers are engaged in affiliate activity, an industry that is now worth about $8B in the US.

From Venus or Mars

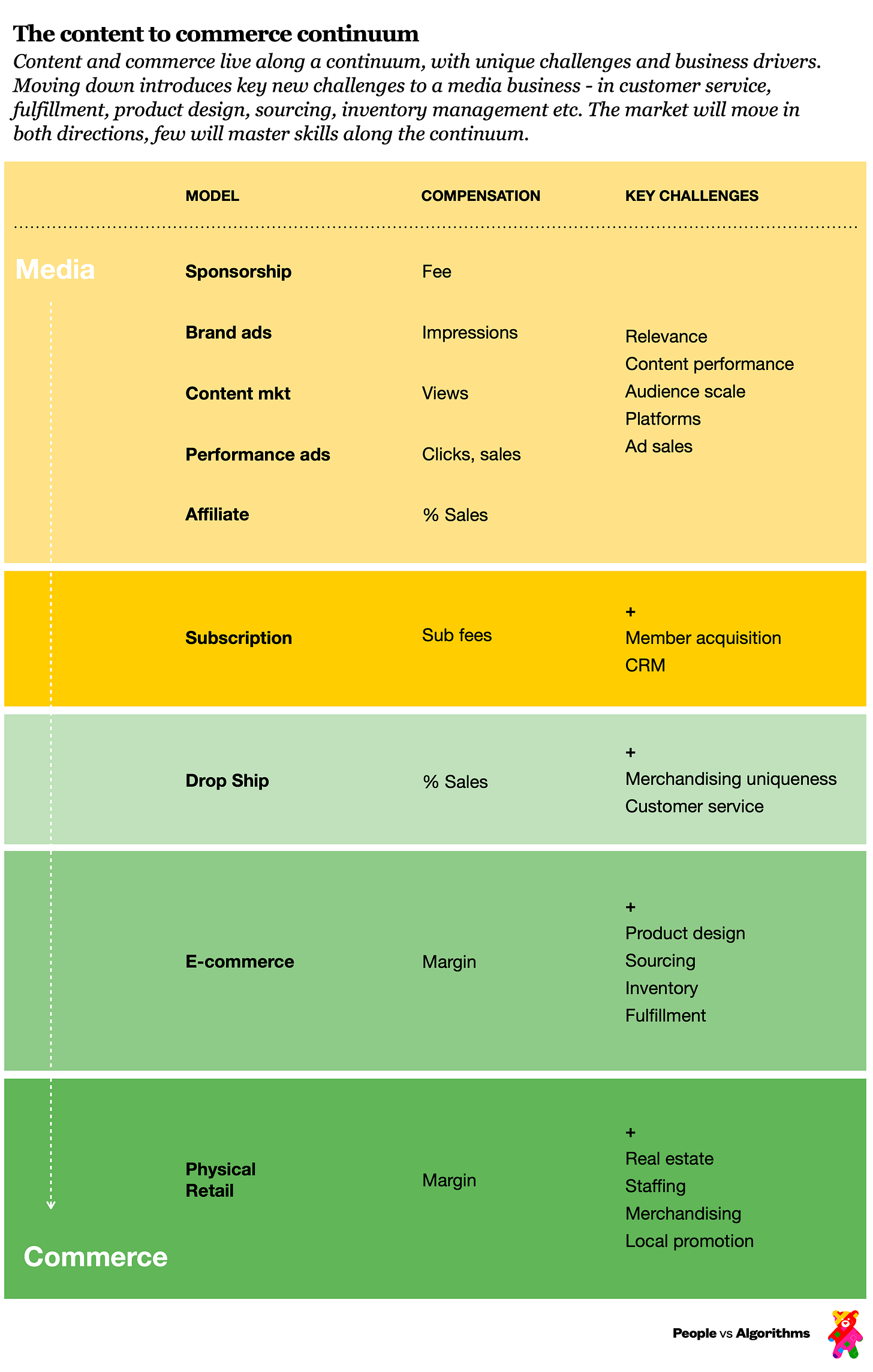

So there is a new intimacy between these two, but let’s be clear, they are very different businesses. I've mapped out the continuum below. While one naturally leads to the other, the skills sets to succeed in each are very different.

We are seeing a media move downward, refactoring content priorities to grow affiliate, prioritizing subscription over advertising. DotDash Meredith, the first big affiliate-driven M&A transaction of the year, was largely a consequence of this new reality (see People vs Algorithms #1). Meanwhile, media companies are trying to figure out if there’s a business opportunity beyond the affiliate click — but the prospect of making products, opening warehouses and managing inventory is daunting to say the least.

And, every brand and merchant are talking about content, tapping media company “brand studios” or honing in-house capabilities to make content. Hybrid media-commerce companies like Goop, Huckberry, Milk Street and Mr. Porter have emerged. Tiffany is hiring Beyoncé and Jay-Z. Mega-influencers have morphed into product brands.

Media and commerce business models differ fundamentally. Media is a game of marginal economics — cover your core content, sales and operational costs and incremental revenue translates to profit. Small media businesses can be decent, sustainable businesses. When they scale, as say Cosmopolitan Magazine did in its heyday, they print money. In this case, diversified subscription, advertising and news stand revenue quickly offset content and operating costs and profits grew non-linearly. Illustrative chart below:

Commerce models, on the other hand, are all about unit economics. Key here is cost of goods sold (COGS) and marketing expense. An experienced merchant drilled this into my head several years ago. If you don't get your COGS under 25% (and less) your model will never make much money. Closely related is marketing expense. Decent gross margin gives you ammunition to acquire customers — through content investment or advertising. Here we typically see costs between 15-18% for direct merchants. Spend above this and things get dicey — which is why Facebook and Google advertising economics are so important to direct sellers. Being exceptional in performance marketing and CRM is a prerequisite for success. Having a brand and products people love, remember and want to engage with is paramount, of course.

The best thing to happen to media since cable

Big picture, the commerce connection is the best thing that has happened to media in the last few years, particularly "lifestyle" media. But we will see impact across all models.

The rough outline of this is pictured below. In short, commerce gives ad supported media incremental revenue and a performance ad model. Platforms become even more vital as transaction environments. Paid media sees new opportunities to make commerce part of a subscription model. Digital native currency, payments and IP mechanisms (blockchain and NFTs) will add fuel to the shift giving content a new way to benefit from secondary transactions.

E-commerce doesn't kill physical retail, but it turns it into marketing

In the old days retail didn’t really need content. Successful concepts would emerge, raise capital and expand geographically. Physicality was a mental reminder and habit forming mechanism for consumers. It was the moat. Online, surface area is unconstrained. Persistent connections to the consumer are elusive and show up as CRM (email mostly), search marketing, advertising, content marketing and loyalty structures like Amazon Prime.

Physical is slowly reemerging as the pandemic wanes, but its nature is changing. Data from the recent Allbirds S-1 gives us a sense of the shifting role of retail:

In 2020, our digital channel represented 89% of our sales, while stores accounted for the other 11% of our sales. Our stores serve as an effective and profitable source of new customer acquisition, increase awareness of our brand, and drive traffic to our digital platform.

Based on this pre-COVID performance, we believe our new stores will be highly profitable, have attractive payback periods, serve as good capital investments, and be positioned well to take advantage of physical retail’s recovery from the pandemic. We also expect net revenue and gross margin to benefit from increased sales through our physical retail channel, which benefits from a lower return rate and decreased shipping costs. We have also seen a corresponding increase in digital traffic and digital sales as a result of store builds in new markets. Furthermore, as we grow our store footprint, we believe we will be able to expand our valuable multi-channel customer base. Across all cohorts and through June 30, 2021, our multi-channel repeat customers, who represented 12% of our total repeat customers as of such date, on average spent approximately 1.5 times more than our single-channel repeat customers.

As an example of the benefits of our vertical retail distribution strategy, our Boston Back Bay store achieved standalone payback within eight months. Furthermore, in the three months after our Boston Back Bay store opened in March 2019, the Boston DMA region saw a 15% increase in website traffic, an 83% increase in new customers and, ultimately, a 77% increase in overall net sales, as compared to a comparable control market.

What makes good retail is not what makes good e-commerce

Think about retail you love and why you love it. First it's probably useful to delineate between "utility" and "passion" retail. The former differentiates on price, convenience and selection, the later on curation, merchandising and taste. It's pretty safe to say that Amazon has completely remade the game in “utility” commerce. The internet makes this category better, I think, as an efficient tool to search, sort, compare, re-order etc. The latter is much more difficult online.

Take formidable merchants like Labour and Wait in the London, New York based John Derian or Le Bon Marché in Paris. It's hard to replicate the experience on a screen — the neighborhood context, juxtaposition and merchandising of products, the staff, the crowd. Here, online success is a function a few things — the most important by a mile is product uniqueness. Merchandising context in the form of inspiration, reviews, instruction etc. would be two, ease and delight of experience would be three. Collectively these reinforce the connection and importance of content. In fact, at the highest level, content and product merge to create a single aspirational experience.

Seems to me that merchants that sit between these modes — “utility” and “passion” will struggle. These are aggregators, mostly driven by drop-shipping. Anyone can be a drop-shipper now, but it's hard to offer anything unique — products, price or service (especially service). “Curation” is not differentiation. Finding margin will be very difficult for all except those who have a very large organic traffic base.

The smart money: The new hybrid

Here’s how I am thinking about this. I believe we are seeing a birth of a new kind of hybrid seller — brand first, digitally native, seamlessly blending content and products. Purpose, uniqueness, customer intimacy and margin are the four pillars I would look for. Underneath, you need fundamental expertise in three areas — product design and sourcing, efficient content production and performance marketing. A recent email exchange with genius Milk Street founder, Chris Kimball provides good perspective:

At the end of the day, it is going to end up being a race to find/create stuff that others do not have and at a low COGS — I think the whole content surround only gets you so far with the same SKUs. And the last bit is the experiential part — if the products are tied into a unique experience (as in we can show you how to use that Urfa pepper) then our product offerings contain more value. So buying a product is only part of the experience — it is just the first step. And this is where triggered Klaviyo emails etc come into play. And, in an odd way, the more personal the brand experience is, the more one is likely to win the shopping race. Where do you feel best spending your money? Amazon or Milk Street?

Obviously everything spins around acquisition cost. The Amazon third-party roll-up frenzy tells part of the story here. Last week, the leading player Thrasio announced $1B financing from Silver Lake. These moves are essentially about buying listing position and Prime designation in the Amazon marketplace — in short, mechanisms to lower acquisition cost. It’s a battle for virtual shelf-space. Thrasio and others will look to grow these brands outside of Amazon. Hard to tell if data, operational synergies and profit aggregation across dozens of direct brands will make the next P&G.

The “utility” game is over unless you can summon a phalanx of warehouses, thousands of employees and a fleet of vans and jets. That said, we are about to see a costly battle in the food space. Fridge No More, welcome to Brooklyn.

Naturally, quality media will sustain. Those that can funnel purchase intent will have much stronger models, others will push to get the audience to pay.

TV will be remade by the convergence as delivery platforms evolve. We are starting to see this with sports betting. Is there any doubt that the Food Network of our near future will look more like Instacart?

BTW, it’s hard not to like marketplace businesses, especially hyper-vertical ones with good community connection. While at Hearst, my team bought Bring a Trailer (BAT), an extraordinary vintage car marketplace centered on a strong point of view. BAT is media (witness higher email open rates that virtually any media property I have looked at), it’s a welcoming place to connect, shop and buy, and it’s a great business. There are others in verticals like audio, outdoor, photography that have similar characteristics. These are curated cuts on eBay and I think they combine with a media mindset very well.

Live streaming is an emerging e-commerce category. I am playing with Popshops, Ntwrk, Whatnot and ShopShops. It’s hard to concentrate scale audiences around a moment. But I like that any seller can jump in. None have really turned me on, but I will reserve judgement for a bit.

Finally (I always seem to do this — but I think this is a huge, disruptive area), the blockchain creates new opportunities to connect the acquisition of assets with community and access. It’s gonna take some time because the territory is conceptually dense, but people will respond to this idea.

Reach out at troy.young@gmail.com if you have thoughts. I would love to hear from you.

Have a great weekend…/ Troy

Bonus tracks

Some of the newsletters I like right now:

The New Consumer, from the brilliant, curious and crystal clear Dan Frommer.

Dan Runcie’s Trapital expertly maps the cultural and business impact of hip hop.

Puck: A new journalist-owned media joint, covering the corridors of power. It’s a great product. I love their new podcast, The Powers That Be.

Bloomberg’s Money Stuff from Matt Levine is good stuff.

The Rebooting is incisive media commentary from journalist, editor and media startup veteran, Brian Morrissey.

Platformer: Casey Newton is smart and he works his beat hard.